Crop Insurance: Safeguarding Agriculture, Mitigating Risks

1. Understanding Crop Insurance

Crop insurance acts as a financial tool safeguarding farmers against losses due to natural disasters, crop failures, or price fluctuations. It’s akin to a safety net for their investments.

Thank you for reading this post, don't forget to subscribe!2. Importance of Crop Insu

Why is crop insurance crucial? Learn how it secures farmers’ incomes, stabilizes food production, and bolsters the agricultural economy, fostering stability.

3. Types of Crop Insu

Explore the diverse range of crop insurance options available—yield-based, revenue-based, and more. Understand their nuances and benefits.

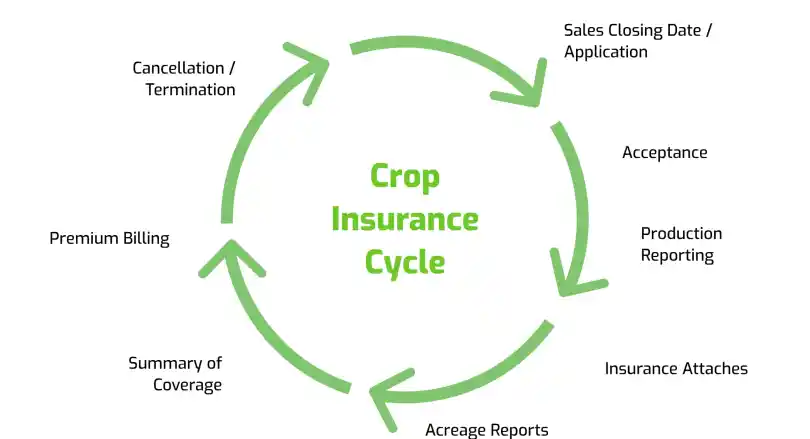

4. How Crop InsurWorks

Dive into the mechanics of crop insurance. Unravel how premiums, coverage, and indemnity payouts function, ensuring a comprehensive grasp of the process.

5. Government Programs and Crop Insur

Governments worldwide play a pivotal role in supporting farmers. Discover various initiatives, subsidies, and collaborations fostering crop insurance.

6. Pros and Cons of Crop Insur

Explore the advantages and limitations of crop insurance. Every policy has its facets; understanding them is key to making informed decisions.

7. Eligibility Criteria and Application Process

Who can access crop insurance? Learn about eligibility criteria and the application process, ensuring inclusivity and accessibility for farmers.

8. Crop Insur vs. Disaster Assistance Programs

Differentiating between crop insurance and disaster assistance programs highlights their roles in risk mitigation and post-disaster support.

9. Impact of Crop Insur on Farmers and Agriculture

Discover the real-world impact of crop insurance on individual farmers, communities, and the broader agricultural landscape.

10. Case Studies: Success Stories

Explore inspiring case studies illustrating how crop insurance transformed the fortunes of farmers, showcasing its effectiveness.

11. Crop Insurance: Future Trends and Innovations

What does the future hold for crop insurance? Explore emerging trends, technological innovations, and potential advancements.

Conclusion

In conclusion, crop insurance isn’t merely a financial instrument; it’s a lifeline for farmers. Its role in stabilizing agriculture, ensuring food security, and empowering farmers cannot be understated.

FAQs

1. What exactly is crop insura?

Crop insurance is a risk management tool that shields farmers from losses due to unforeseen circumstances like natural disasters, crop failures, or price fluctuations.

2. How does the government support crop insur?

Governments often provide subsidies, collaborate with insurance companies, and create programs to make crop insurance accessible and affordable for farmers.

3. Can all farmers access crop insur?

While eligibility criteria may vary, governments strive to ensure inclusivity, making crop insurance accessible to a majority of farmers.

4. Is crop insur the same as disaster assistance programs?

No, they serve different purposes. Crop insurance is proactive, offering risk mitigation, while disaster assistance programs provide support after disasters strike.

5. How does crop insur benefit agriculture as a whole?

Crop insurance fosters stability, ensuring continued food production, safeguarding farmers’ livelihoods, and bolstering the agricultural economy.